IFTA Quarterly Fuel Tax Reporting

The Easiest Way

to Get Your Fuel Taxes Done. Period!

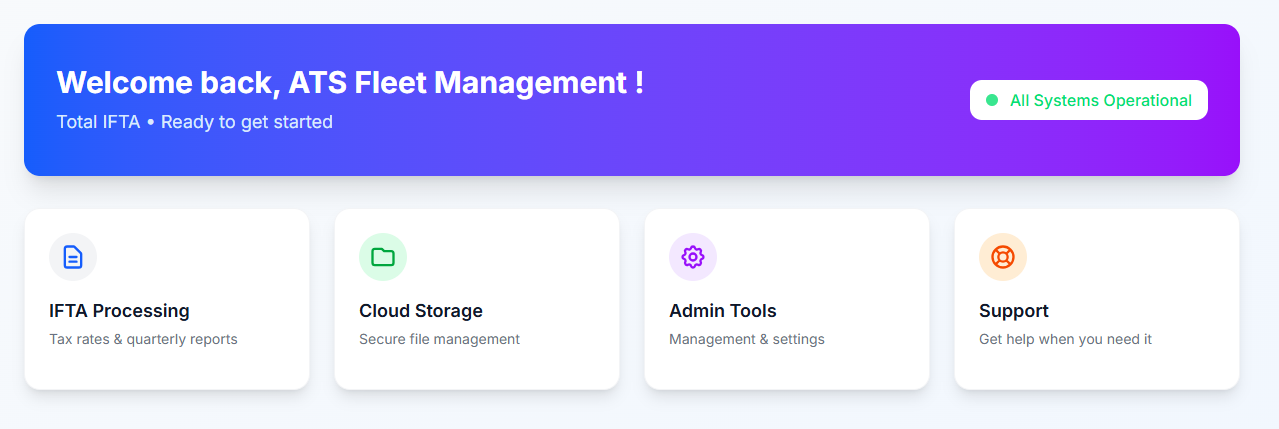

Spend less time filing fuel taxes and more time on the road. Total IFTA is the simple IFTA solution for drivers, built for speed, accuracy, and ease of use.

Regardless of the size of your organization, Total IFTA helps you process your IFTA reports in minutes – without the headache.

Full Featured IFTA Fuel Tax Reporting Solution

Everything you need to complete your IFTA Fuel Tax Reporting requirements quickly, and affordably!

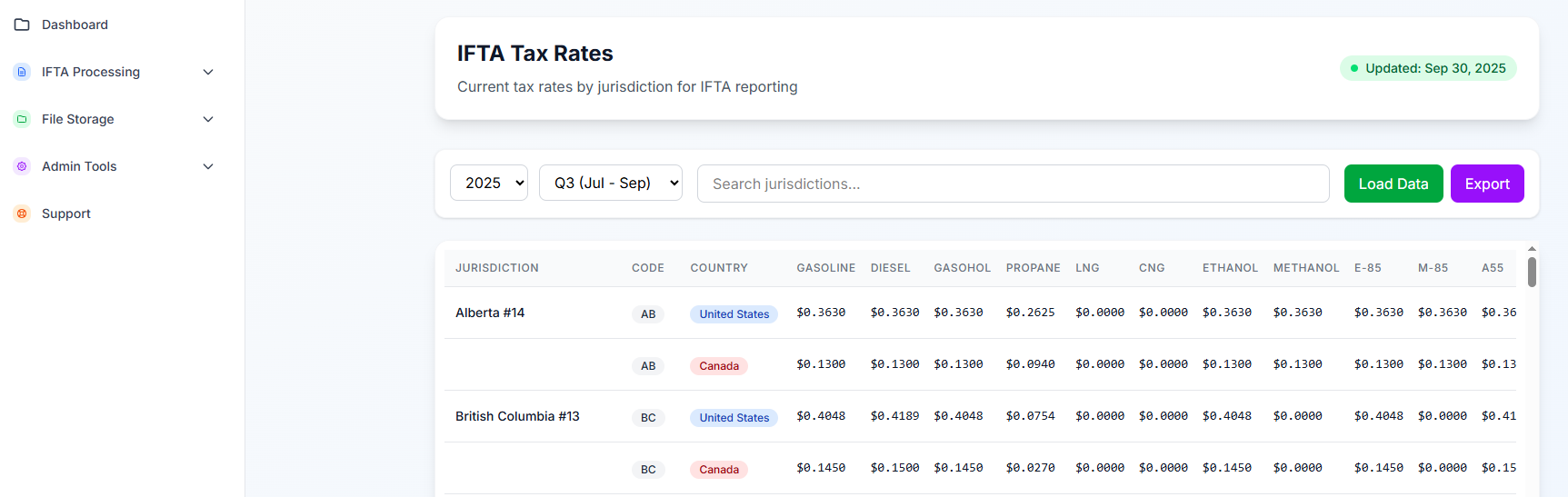

Fuel Tax Rates

Fuel Tax Rates, Surcharges and Intermittent Rate Changes are automatically downloaded and recorded ensuring your report calculations are always accurate, up to date and ready to file!

ELD Integration

Easily import quarterly miles traveled and fuel purchased for each of your fleet vehicles using our ELD Integration. Using this technology, we are able to pull data directly from your company ELD.

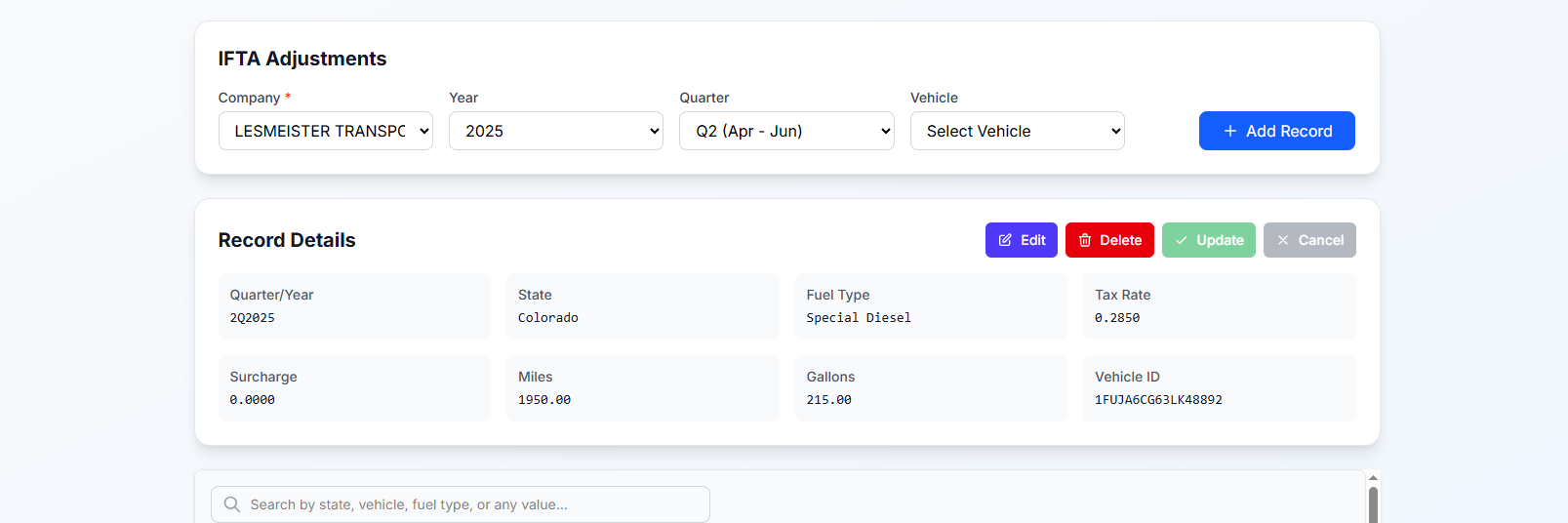

Mileage and Fuel Adjustments

An Adjustment feature and Mileage Calculator lets you make changes to your report detail when necessary to ensure your reporting is as accurate as possible when filing your fuel tax reports with your home state.

Key Features of Total IFTA Qtrly Reporting

Easy Data Integration

There are many ways to import State Mileage and Fuel Purchase detail into the Total IFTA Solution, making completing Fuel Tax Reporting a breeze!

Save Time & Money

Using our proven solution, you are easily able to complete your Quarterly IFTA Fuel Tax Reporting Requirements quickly, saving you lots of time and money!

Single Button Click Reporting

Once data has been entered for your fleet, IFTA Reporting can be accomplished with a single button click. IFTA Reports produced can then be used for your quarterly filings.

Reporting and DOT Compliance

IFTA Quarterly Reports must be kept on file for 4 years. However, the system retains IFTA Reports indefinitely to ensure DOT Compliance is fully maintained.

Advanced Feature Set

Along with ELD Integration and Single Button Click IFTA Fuel Tax Reporting, are a couple of advanced features you need to know about.

First, is the IFTA Adjustments and Mileage Calculator that allow you to easily make corrections to Mileage and Fuel Purchases and recreate trip mileage from trips not counted in your data.

Also, users of the Total IFTA Application also have access to an online support feature, as well as our IFTA Hotline so you can get help when you need it!

Built for Resellers, Owner-Operators

& Fleets of All Sizes

We created Total IFTA to take the stress out of quarterly tax filing for those who don’t have time to waste. It’s the best IFTA software for owner-operators and an ideal solution for small trucking companies looking to stay compliant without hiring a tax service.

GET STARTED TODAY